Start With Clear Financial Goals

Every successful investment strategy begins with clearly defined personal goals. Without direction, your investment decisions can end up reactive instead of strategic. Here’s how to establish a solid foundation:

Determine Your Investment Timeline

Understanding when you’ll need access to your money is essential for setting the right risk and return expectations.

Short term goals (1 5 years): Examples include saving for a vacation, home down payment, or a wedding. These goals require more conservative investments to reduce the risk of losing money.

Long term goals (5+ years): Think retirement, a child’s education fund, or generational wealth building. Longer timelines allow for riskier investments with higher growth potential.

Clarify Your Risk Tolerance

Know how much volatility you can handle emotionally and financially. Risk tolerance affects not just your portfolio composition, but how likely you are to stick with your strategy when markets swing.

Ask yourself:

How did I feel during the last market downturn?

Am I comfortable seeing my investments drop 10 20% in value temporarily?

Do I prioritize growth, or protecting what I already have?

Align Your Strategy With Life Milestones

Your investments should map to real, measurable outcomes in your life. Building a strategy around concrete goals keeps you focused and motivated.

Planning to buy a home? You might prioritize safer, more liquid assets.

Targeting early retirement? You’ll need higher growth assets with long term potential.

Expecting major life changes (kids, relocation, career shift)? Flexibility becomes key.

Setting clear financial goals upfront helps you design a portfolio that works with your lifestyle not against it.

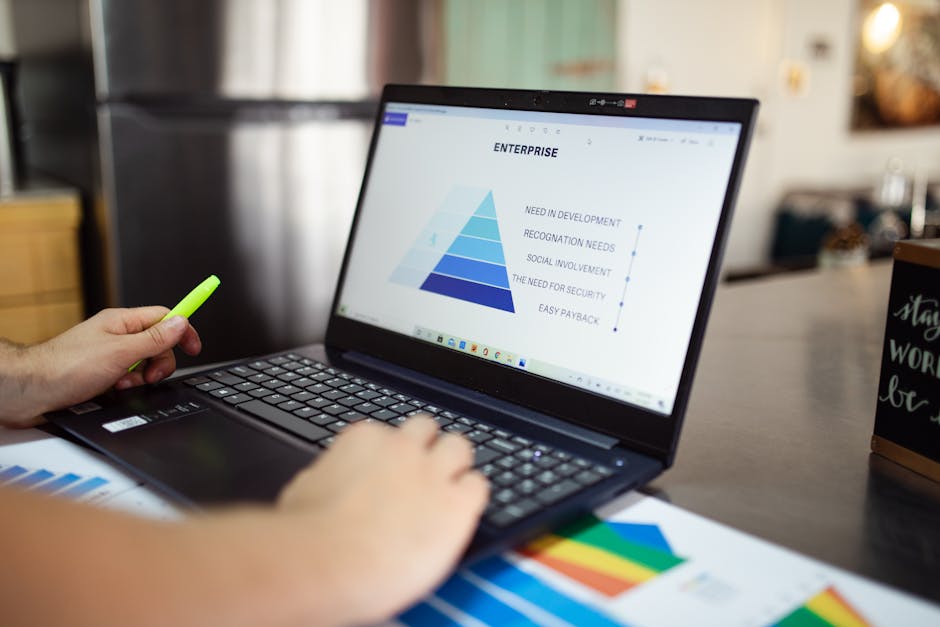

Understand Your Investment Options

Before you build a balanced portfolio, you need to get familiar with the tools in your investment toolbox. Here’s a quick rundown of the major asset classes you’ll be dealing with:

Stocks These are your main drivers of growth. When you own a stock, you own a slice of a company. With that comes the potential for high returns but also volatility. Stock prices can swing fast, and market sentiment plays a big role. It’s about long term gains, not short term timing.

Bonds Bonds are the steady hands in your portfolio. You lend money to a company or government, and in return, you get periodic interest payments. They’re less volatile than stocks, but tend to offer lower returns. Think of them as your portfolio’s anchor.

Real Estate Buying property is one way to put your money into tangible assets. Whether you go direct (rental properties) or via something like a REIT, real estate can provide income through rent and potential value appreciation. It’s less liquid, but can help hedge against inflation.

ETFs and Mutual Funds If picking individual assets isn’t your thing, these are your go to. They bundle a bunch of investments into one, giving you instant diversification. ETFs usually come with lower fees and trade like stocks. Mutual funds are more hands off but often cost more.

Cash & Cash Equivalents Think savings accounts, CDs, and money market funds. These are easy to access and come with almost no risk. But they barely beat inflation so while they’re great for emergencies, they shouldn’t dominate your long term strategy.

Each class plays a different role. Know the trade offs, mix accordingly, and you’ve got the foundation of a solid strategy.

Build a Balanced Portfolio

Diversification isn’t just a buzzword it’s a buffer against volatility. By mixing asset classes like stocks, bonds, real estate, and cash equivalents, you reduce the chances that a downturn in one area wipes out your entire portfolio. Each type of asset behaves differently under stress. While stocks can tank, bonds might hold steady. When real estate slows down, cash can give you options. Own a bit of everything, and you’re naturally hedged.

But diversification isn’t a set it and forget it move. Over time, some investments will outperform others, throwing off your balance. That’s where rebalancing comes in. If you start with a 60/40 stock to bond split, and after a few strong years stocks swell to 75%, you’re carrying more risk than you planned for. Rebalancing selling some stocks and buying more bonds in this case brings your portfolio back to your original risk level. Best practice? Review allocations either annually or any time your mix shifts beyond 5% of your target.

There’s no one size fits all answer. The classic 60/40 strategy might work for a mid career saver, but a younger investor could lean heavier into stocks say, 80/20. Meanwhile, someone nearing retirement might slide the other way. Customize your mix based on your goals, tolerance, and time horizon. The best portfolio is the one you can stick with even when markets get rough.

Deep Dive Into Stocks

Hype moves fast. Good companies move deliberately. When building a stock portfolio, skip the trending tickers and look for businesses with strong fundamentals clear revenue growth, steady profit margins, healthy cash flow. It’s not flashy, but it’s what gives a portfolio staying power.

That’s where metrics come in. Get comfortable with things like earnings per share (EPS), return on equity (ROE), debt to equity, and price to earnings ratio (P/E). These numbers won’t tell you everything, but they’ll tell you enough to spot red flags and long term value. Dig into this stock evaluation metrics guide if you’re not sure where to begin.

Finally, don’t stack your entire portfolio in one industry. If all your picks are in tech or energy or retail, one market swing can drag everything down. Spread your investments across sectors. Think healthcare, consumer goods, industrials, and beyond. Variety makes your portfolio stronger and a lot less vulnerable to sudden shocks.

Avoid Putting All Your Eggs in One Basket

Diversification is more than a cliché it’s one of the most effective ways to manage investment risk over time. Putting too many of your assets into one area can leave your portfolio vulnerable to unexpected shifts in the market.

The Risk of Over Concentration

Relying too heavily on a single asset, sector, or company may yield temporary gains, but it opens the door to significant downside when things change.

Company specific risks (e.g., poor management, regulation changes)

Sector downturns can wipe out gains across similar investments

Lack of balance increases portfolio volatility

Tip: Even successful companies can falter. A diversified portfolio helps protect against losses in one area by balancing gains in another.

Don’t Ignore Global Markets

Limiting your investments to your home country may feel familiar, but it often limits your returns and increases risk exposure.

Geographic diversification spreads risk across economies, currencies, and markets

Emerging and international markets can offer stronger growth potential

Developed markets abroad may present stability during local downturns

Reminder: Different countries peak at different times. Having a global outlook builds resilience in shifting economic conditions.

Emotional Discipline Matters

Markets rise and fall that’s inevitable. What matters most is how you respond.

Avoid impulsive decisions during volatility

Stick to your long term investment plan, even in downturns

Revisit your goals when emotions run high, not the news headlines

Final Thought: Discipline often beats talent when it comes to investing. Stay calm, stay diversified, and focus on the bigger picture.

Keep Costs and Taxes in Check

It’s easy to overlook fees and taxes when you’re chasing returns, but ignoring them eats into your bottom line. Expense ratios the annual fee funds charge to manage your money may look small at first glance (0.03% vs. 1%), but over time, they make a big difference. Pay attention to them before you commit. Cheaper isn’t always better, but it usually is.

Capital gains taxes are another silent killer. When you sell an investment for a profit, the government takes its cut. Short term gains (on assets held less than a year) are taxed at regular income rates. Long term gains get a break, but they still reduce your take home. The fix? Don’t churn your portfolio out of boredom. Also, hold in tax advantaged accounts when you can IRAs and 401(k)s let your investments grow tax deferred or even tax free.

Then there’s the active vs. passive debate. Chasing the market with active funds or DIY trades may seem exciting, but it’s tough (and expensive) to win that way consistently. Passive investing index funds, ETFs tends to outperform after fees are factored in. It’s a slow burn, but a solid one. Know what you’re paying, where your gains are going, and how much of it you actually get to keep.

Monitor and Adapt

Building a solid portfolio is only the first step. The real work is in staying on top of it. At a minimum, give your investments a hard look every quarter or twice a year. Not every detail needs to change, but trends shift, companies evolve, and your needs won’t stay static.

As your holdings grow, revisit the fundamentals. Rerun your stock evaluation metrics to make sure those once promising picks still hold up. Got a company that looked great a year ago but now shows declining margins and weak leadership? Time to rethink.

And life changes fast. Maybe you got a raise. Maybe you had a kid. Maybe you’re chasing early retirement now. Whatever it is, your portfolio should reflect your reality. That might mean leaning more conservative, or pivoting to higher growth plays. In all cases, adapt with intention, not impulse.

Final Take

Diversification doesn’t need to be complicated. It’s not about owning dozens of assets just to check a box it’s about building a portfolio that can take a hit and still stand. One sector drops, another holds the line. One region’s in recession, another’s growing. That balance is what helps you stay in the game.

Consistency matters more than perfect timing. Set a regular schedule to check in on your investments, even if it’s just twice a year. Keep learning markets change, tools improve, new opportunities show up. The more informed you stay, the less likely you’ll panic when volatility hits.

Let your strategy breathe. Long term investing works when you give it time. Trying to outsmart the market every month is a fast track to burnout and regret. Instead, build your plan on things that last: clear goals, smart allocation, and a mindset that plays the long game.